In the rapidly growing GameFi industry, the market worth has already surpassed $14 billion and is projected to reach an astounding $50 billion by 2025. The potential of GameFi, its high user engagement, and exponential community growth have attracted numerous founders. However, the survival of crypto games hinges on well-developed tokenomics, the backbone of a project's economic and value systems. In this article, we will share our expertise to guide you in crafting robust tokenomics for your crypto game, ensuring optimal engagement and financial success.

Exploring Tokenomics Models

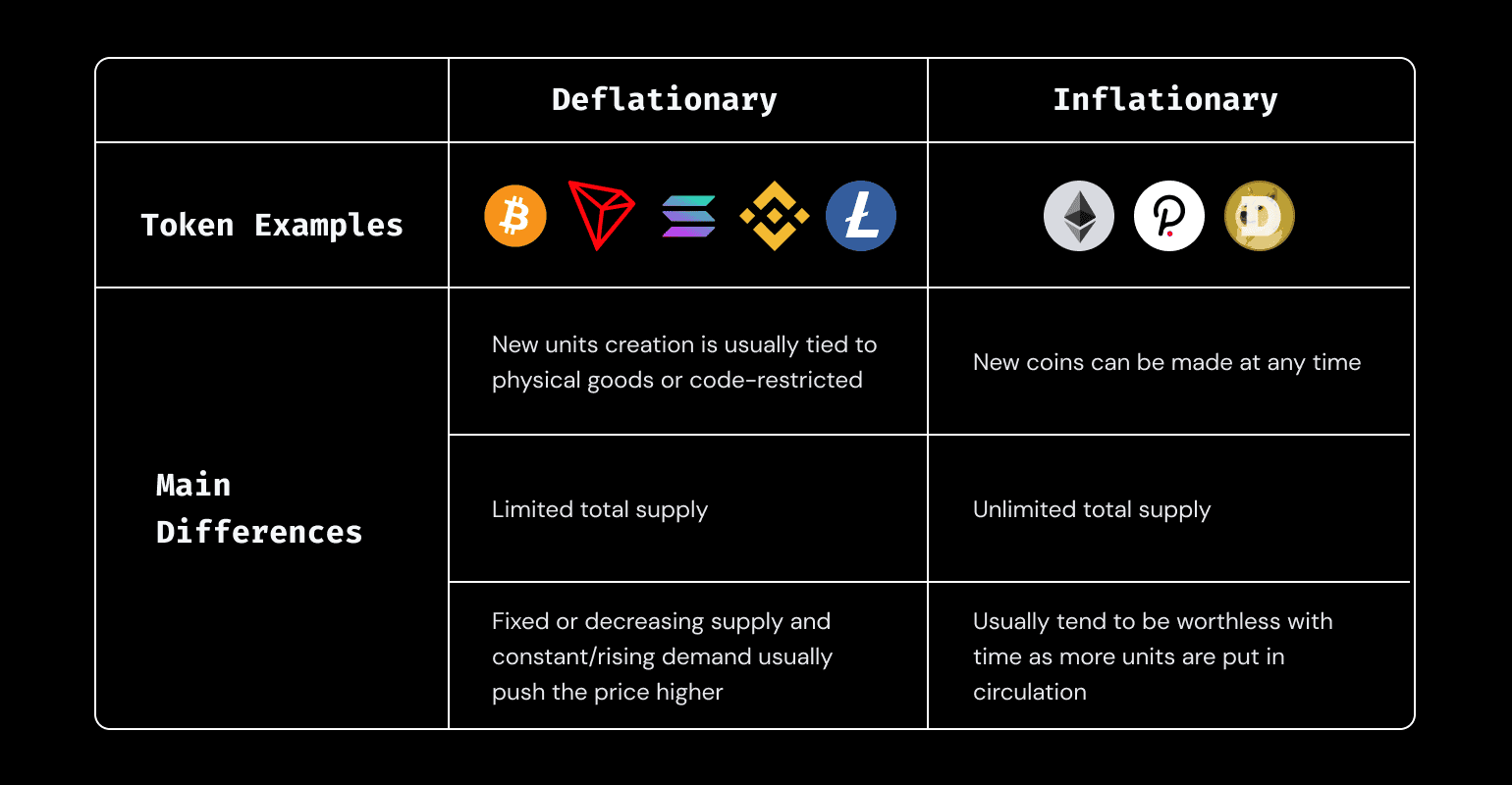

Tokenomics and cryptocurrency are deeply intertwined and immensely popular today. Most projects have adopted deflationary or inflationary tokenomics models. Deflationary models involve a fixed token supply, creating demand and enticing investors. Bitcoin, Litecoin, Solana, Tron, and other renowned cryptocurrencies operate under this model. In contrast, inflationary models like Ethereum, Polkadot, and Dogecoin feature unlimited token supplies but employ mechanics to control inflation or create deflationary systems.

Distinguishing Deflationary and Inflationary Tokens

Deflationary and inflationary tokenomics models can manifest in various ways. Here are a few key models commonly found in crypto gaming tokenomics:

Basic Deflationary Model (e.g., BTC, XRP, SOL)

A fixed number of tokens is released during a token generation event, stimulating demand and attracting investors.

Buyback and Burn (e.g., BNB):

The project repurchases tokens from holders and burns them, reducing the token supply and balancing the economy.

Burn on Transaction (e.g., SAFEMOON):

A transaction tax is applied and either burned or distributed among token holders, regulating the total token supply.

Net Deflationary Model (e.g., CRV):

Although there is no maximum token supply, the burn rate from taxes or buybacks compensates for the issuance rate, creating demand.

Token Mechanics: Essential Elements and Interactions

To develop a powerful tokenomics system for your blockchain game, you must comprehend the various elements and their interactions. While familiar with the concept of smart contracts, it is crucial to delve into the mechanics that create, route, and alter tokens. Let's explore the essential token mechanics:

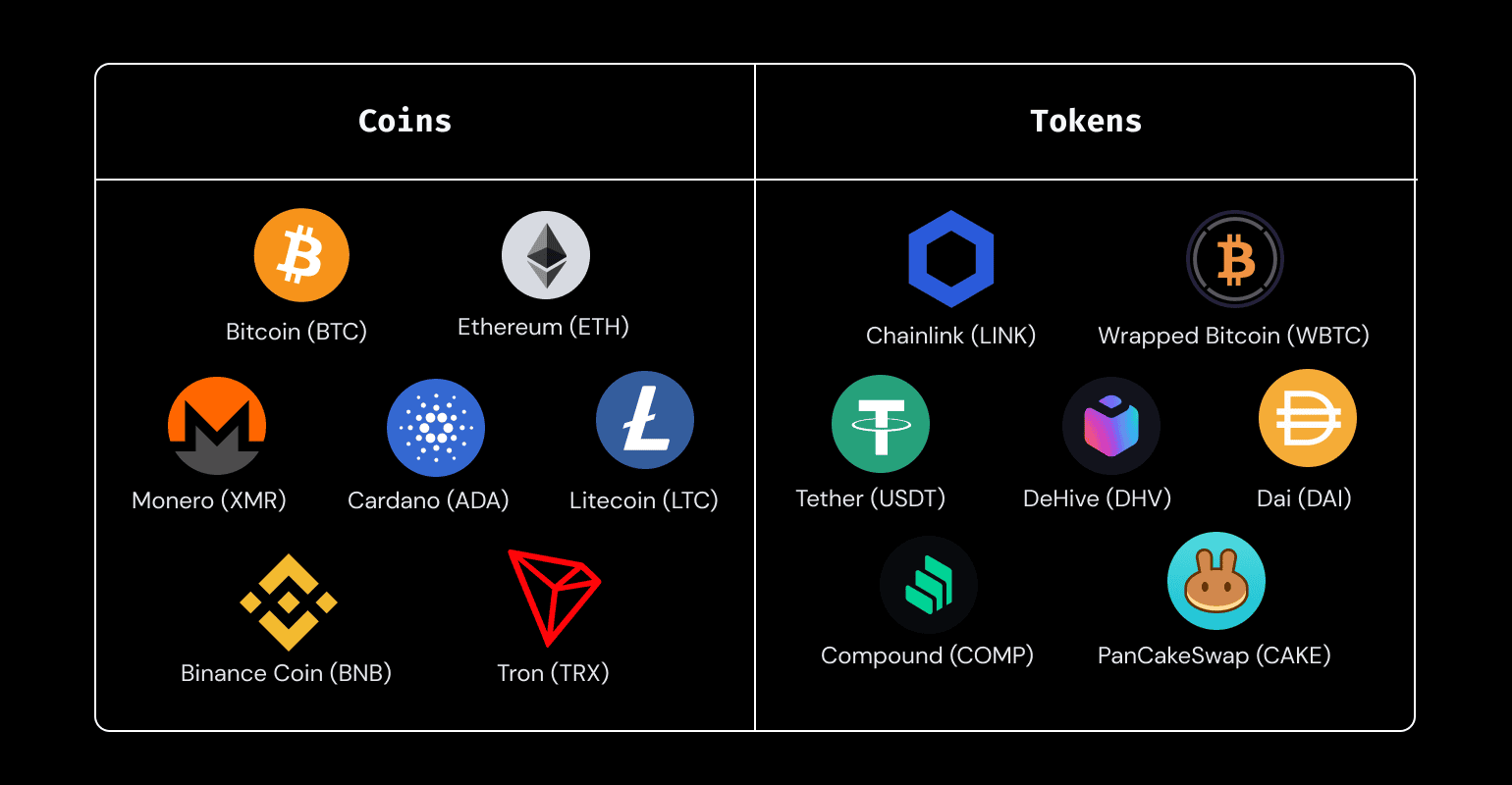

Coins & Tokens

Coins and tokens, although often used interchangeably, carry distinct meanings. Coins represent digital money and store value, while tokens provide utility or ownership of assets. Tokens can be categorized as utilities, securities, or non-fungible tokens (NFTs), which play a significant role in game tokenomics.

Fungibility

Fungibility defines a token's exchangeability with others. Fungible tokens can be easily exchanged without loss of value, while non-fungible tokens are unique assets with specific metadata, making them distinguishable and non-exchangeable.

Buyback and Burn

This mechanism involves the repurchase and subsequent burning of tokens by the project, reducing the token supply and maintaining a balanced economy.

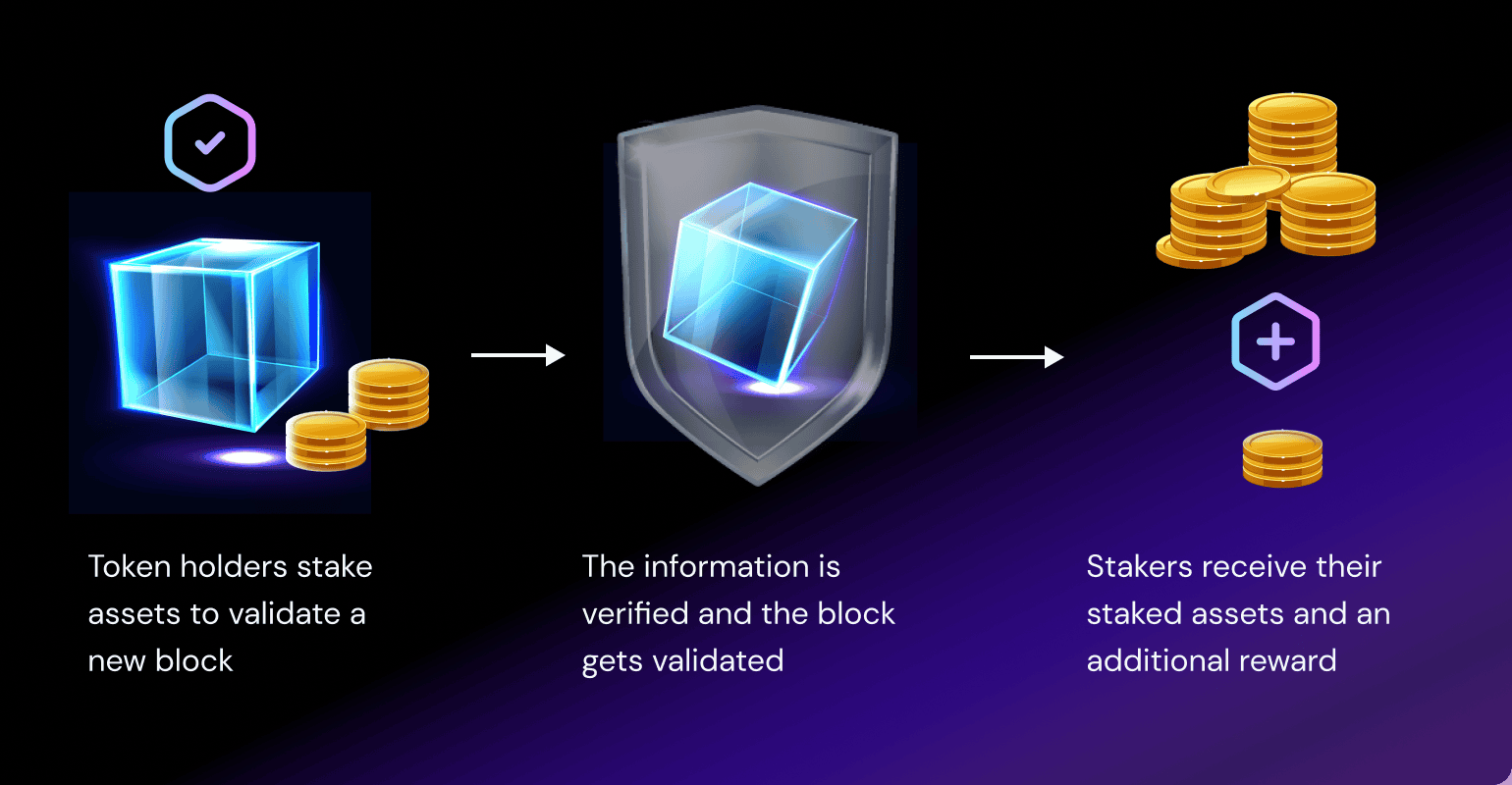

Minting

Minting encompasses the process of creating new tokens, whether through Proof-of-Stake protocols, initial token supply, or tokensales.

Issuance

Issuance involves the distribution of tokens through various methods such as pre-sales, IPOs, direct purchases, rewards, or airdrops. Vesting periods may be implemented to stabilize token demand and value.

Burning

Burning permanently removes tokens from circulation, either by smart contract-based reduction or by sending them to an inaccessible wallet, effectively regulating the token supply.

Inflation

Inflation in the blockchain industry occurs when the total token supply increases through constant minting or issuance. However, mechanisms within crypto tokenomics control the value despite inflation.

Staking

Staking refers to locking tokens in a wallet to validate blocks and earn rewards. In games, staking can be used to distribute revenue among players.

Coins & Tokens

Coins and tokens, although often used interchangeably, carry distinct meanings. Coins represent digital money and store value, while tokens provide utility or ownership of assets. Tokens can be categorized as utilities, securities, or non-fungible tokens (NFTs), which play a significant role in game tokenomics.

Treasury

The treasury acts as an address that accumulates and distributes tokens based on predefined rules. Tokens can be distributed through staking, player rewards, team remuneration, or liquidity provision.

Voting

Voting allows token holders to participate in the governance of decentralized systems, including crypto games. It empowers players to influence game development, treasury mechanics, and community support.

Pegging

Pegging involves tying the value of a token to another asset, be it cryptocurrency, fiat, or real-world commodities, providing stability and predictability in trading.

Wrapping & Bridging

Wrapping and bridging facilitate the transfer of assets between different blockchains. Tokens can be locked on one blockchain while a wrapped version is created and traded on another chain.

Motivating Participants in Crypto Games

In the realm of crypto game tokenomics, motivation is a critical factor for players, developers, and investors. Understanding their needs and designing incentives are vital for a thriving ecosystem.

Players

Crypto games employ a dual motivational system: Play-for-Fun (P4F) and Play-to-Earn (P2E). P4F games focus on leisure, while P2E games provide monetary incentives through token rewards for in-game achievements and content generation.

Developers

Internal developers receive compensation based on performance, while external developers can be incentivized through monetary rewards or community recognition.

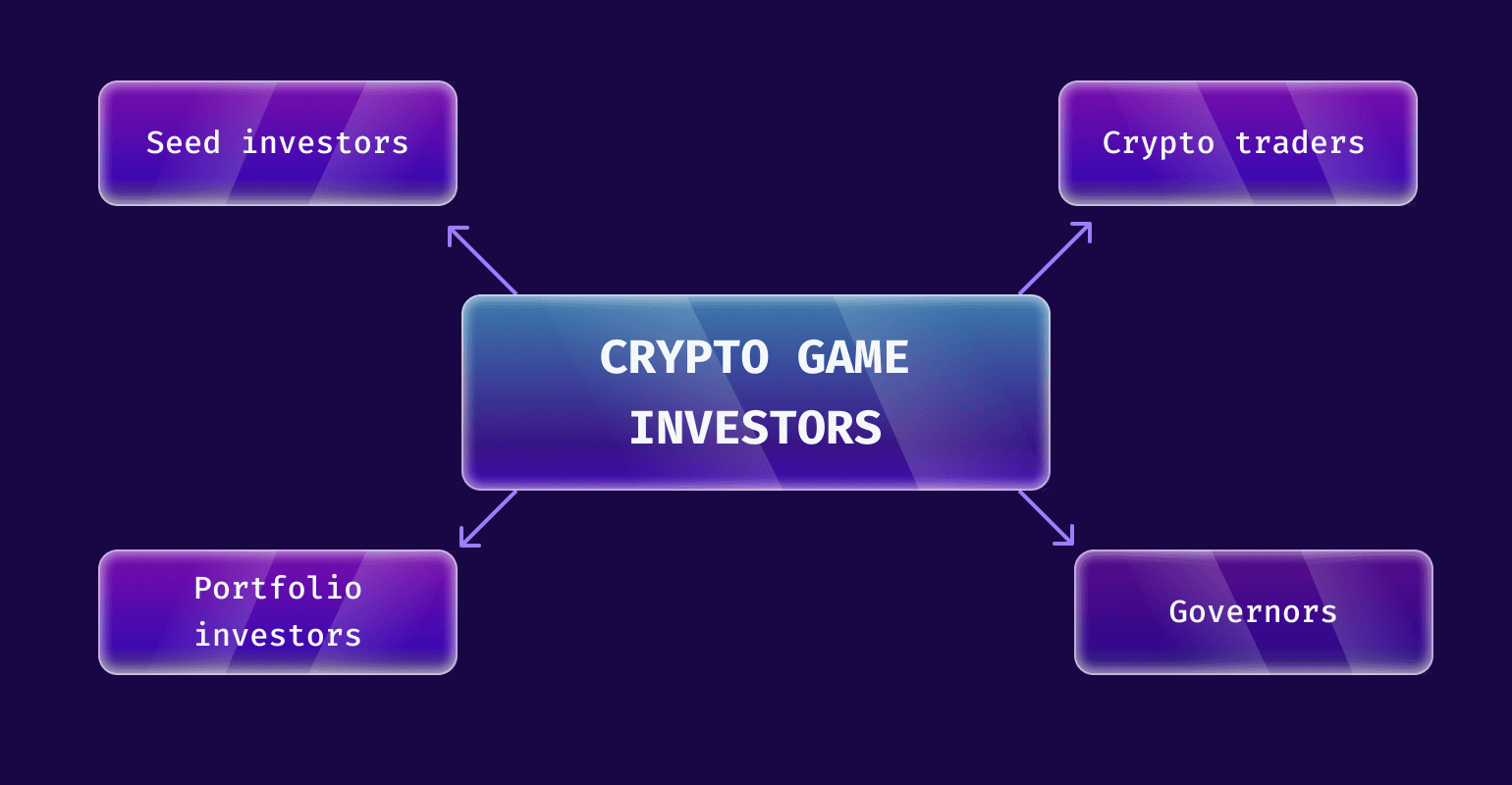

Investors

Investors support game development and expect to profit and increase their capital. They can be backers, portfolio investors, governors, or crypto traders.

Different Types of Tokenomic Systems

Several tokenomic designs have emerged in the crypto gaming industry:

Play-to-Earn (P2E)

P2E games motivate players through rewards, often in the form of tokens or NFTs. Liquidity and the ability to exchange tokens for fiat currencies are crucial in P2E games.

Voting and Dividends

Governance tokens enable voting rights and dividend distribution, providing token holders with passive income from the game's treasury.

Tokensales

Tokensales, including pre-sales and IPOs/ICOs, allow investors to acquire tokens. Governance tokens grant voting rights, while utility tokens offer in-game benefits.

External Sources

Exchanges, dApps, and NFT marketplaces contribute to the tokenomics of games by increasing liquidity and trading opportunities.

Developing Your Crypto Game Economy

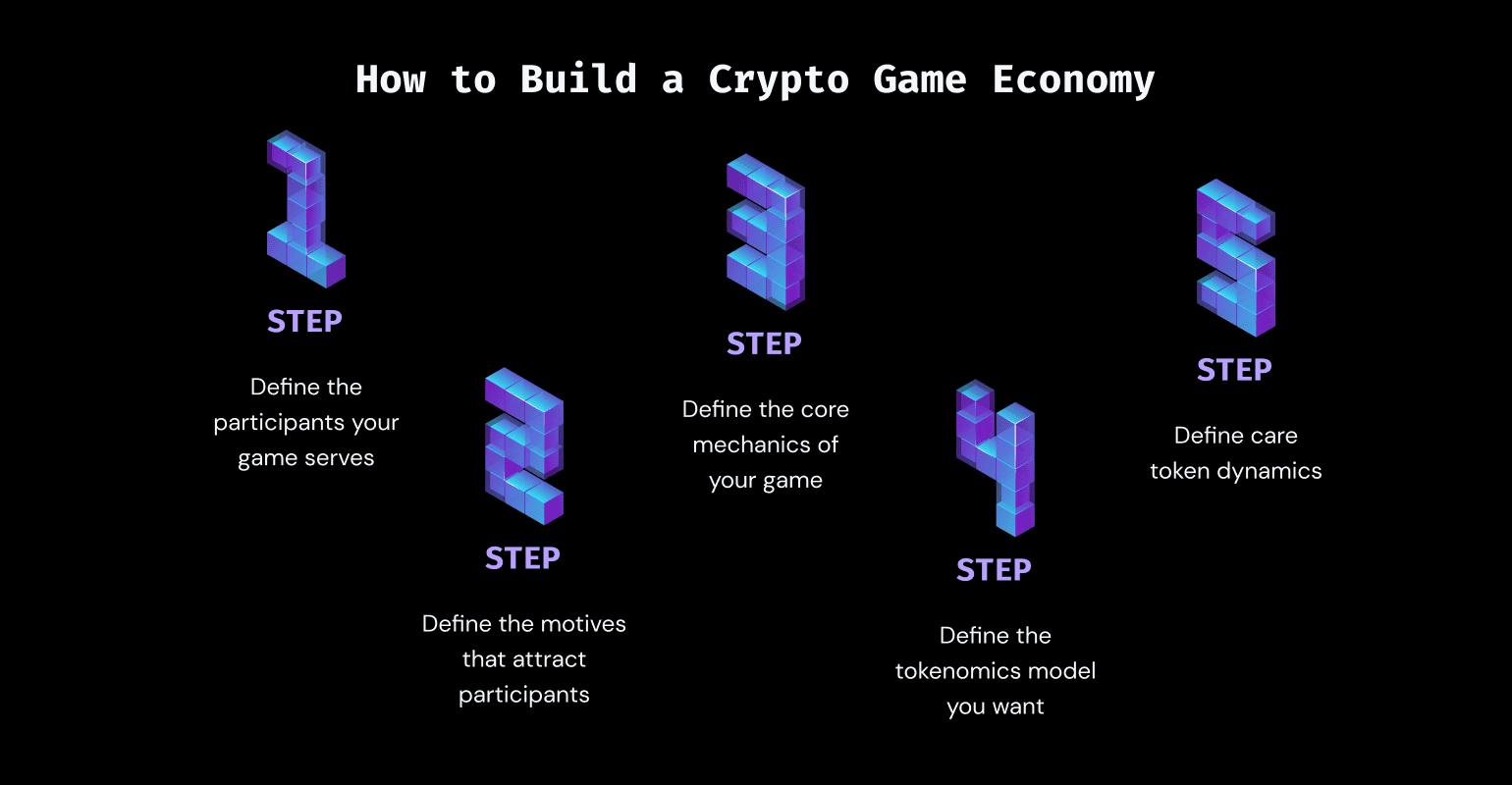

To construct a successful crypto game economy, follow these essential steps:

Step 1. Define the Participants

Identify the parties involved, including external developers, investors, and potential players, to tailor your tokenomics accordingly.

Step 2. Determine Motivations

Understand the motives and expectations of each participant group to design effective incentives and engagement strategies.

Step 3. Define Core Mechanics

Craft unique game mechanics that set your game apart, ensuring community growth and popularity.

Step 4. Choose Tokenomics Model

Select the appropriate tokenomics model and decide on the functions and supply of tokens within your game ecosystem.

Step 5. Establish Token Dynamics

Strategize how tokens enter and exit circulation, ensuring an optimal balance between supply and demand, as well as ample opportunities for players to spend their tokens.

Conclusion

Developing tokenomics for a crypto game is a complex process requiring meticulous planning and expertise. It is advisable to engage experienced professionals who specialize in this field to ensure the success and profitability of your game. By partnering with our [website] team, you can leverage our five years of experience in the blockchain and crypto gaming industry to develop a thriving game economy. From smart contracts to token mechanics, we provide comprehensive services tailored to your needs. Visit our website to learn more about our expertise and explore our success stories.

[Disclaimer: This article does not constitute financial or investment advice. It aims to provide general information about tokenomics in the context of crypto games. Always conduct thorough research and consult with professionals before making any investment or financial decisions.]